This site contains affiliate links to products. We may receive a commission for purchases made through these links.

Do you struggle with your finances? Does figuring out where your money goes each month leave you confused and scratching your head? You are not alone and believe me…you need an easy budget for beginners.

Budget means the amount of money that is available for, required for, or assigned to a particular purpose. To plan coordinating resources and expenditures for use. You can learn exactly how to make a budget that is perfect for you without being overly complicated.

Starting a budget when you are a beginner can be hard! (especially if you have never budgeted before, I should know…that was me once)

I have failed so many times at it that it’s not even funny! (but I have learned so much because of my failures and I want to share all my knowledge with you)

If you are feeling alone in your financial battle…you are not. Take it from me, it’s your money and you should tell it where to go and how it’s going to work for you.

Start Simple

If there is one thing that I have learned from my years of experience with goofing up, it’s that you need to start simple. This is something I wish somebody would have told me years ago.

You have to make it simple.

I would overcomplicate things and that would make me quit before I could get my budget under control. It’s like when your kids trash the house and you don’t know where to start cleaning up. (PS- I’m not cleaning until they go to college, lol.)

Pick a simple task and get started.

There is just no reason for you to make it more difficult than it has to be.

So in this post, I’m going to share all the things I learned as a brand new budgeter that has gotten me where I am today… A Badass Budgeted Mother and it will blow your mind.

First, you need to take a deep breath. Let’s be realistic. Making a budget is hard, sticking to it is even harder, but I know you can do it. I’m proof it can be done.

I tried so many that I would get confused and frustrated which led to me giving up and not following through. But you can learn from my mistakes and take it easy. The secret to this is not to rush!

Starting Your Easy Budget for Beginners

Start by grabbing a piece of paper. (yes, it is really that simple.) I told you we are keeping this simple.

Some notebook paper, computer paper, your kid’s doodle paper…whatever you got.

Take a minute and write down all your bills.

Every…single…one. This process needs to be easy. When I made mine, I pulled up my previous month’s bank statement to help me with the dates bills were paid and the amounts that were paid.

I wrote them all down and checked to make sure everything had been accounted for. (nothing is too small or silly to add to your budget if you spend money on it than it needs to be budgeted)

Then I went through and wrote each of them by the date they were due on a separate piece of paper.

At the top of the paper, I made a line for each of our paychecks. We (my husband and I) get paid every two weeks on opposite weeks so there is always a check coming in.

My checks are not always the same because I get paid mileage, hourly, bonuses, and sometimes commission so it’s hard to know exactly how much I get. My husband’s checks are pretty close to being the same so they are easier to guess.

When you are first creating a budget it’s better to put down the lower of the guesstimation for your income (if it’s not consistent each time).

It is better to make sure everything can get paid off the minimum. You can also take your yearly from your W-2 and divide it by 12 if you want to have a better guess.

If you end up with more money than your budgeted amount, you can put the difference into savings or use it to pay down debt if you guessed low and made more for a month (just a thought).

You can utilize our easy customizable budget planner here.

Earn Some Extra Money

If you write all of these down and realize you need some extra cash flow, try these ways to make some extra cash:

These are a few ways to make some extra money at home, you can do some pretty easy side hustles to get extra funds.

Surveys:

Some of my favorite money-saving apps is:

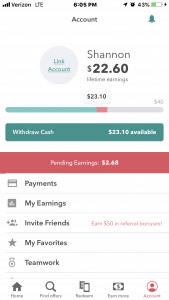

I use Ibotta to get money back when I shop. They have great offers and it is super easy to use! I earned $22.60 in my first 2 weeks of having the app. Below is a screenshot:

This is my favorite app to save money on gas. I get on average .15-.25 per gallon back!! It maps out the participating gas stations and shows you their price. You then, claim the price…get gas…and upload your receipt.

Check out this post the Best Apps for Saving Money, it goes in-depth about a few more.

Money Making Ideas: Blogging, Selling Clothes on Poshmark, Other Ideas Here.

Budget Categories

So we are ready to dive into the budget…

Once you have written out all of the things you spend money on, you need to categorize them. Every expense needs to go into a category where you will set amounts that are to be spent.

Creating budget categories is based on each individual. You should decide what your budget should be. We don’t all have the same bills or the same money goals and this is ok.

In my house, we have decided our goal is to pay down all of our debts. We have recently (in 2021) paid off my car completely.

We also, don’t have a television subscription, so my stuff would be a little different than most because we use Hulu for our tv.

Grocery Budget

The hardest category for me to budget is groceries. This is the one that fluctuates the most and is never consistent. It’s because I use different grocery stores, I don’t pre-plan my week’s meals, I live on a whim, blah blah blah. (I am currently working really hard to change this bad habit!)

Update: as of 2021 we have gone vegetarian to lose weight and I have gotten really good at pre-planning! yay!

Click Here to find out what I did to lower my grocery bill by hundreds each month.

You can also read my post about how to grocery budget here: A Simple Grocery Budget You Can Stick With it can save you thousands!

I know…most of you do at least one of the things I mentioned that I do. It’s ok. All you need to do for success is set an average amount and once you get the hang of this budget for beginners thing, you can re-focus on mastering the grocery budget.

I also love Erin Chase’s Grocery Budget Makeover course. It has been a game changer!

Other Budget Categories

A few more areas that need to be addressed are categories like:

- Utilities

- Rent/Mortgage

- Car Payment

- Insurance

- Medical/ Insurance

- Debt

- Childcare

- Phone

- Household expenses

- Miscellaneous

- Savings

- Retirement

When I created my first budget, I focused on the bills that I had each month. At some point, every penny needs to be addressed, but when you start you can do the big stuff. This is just the beginning, when you get this mastered you can go back and add categories like “miscellaneous spending”.

The thing about a budget that will work for you is it needs to be tailored to your needs. The easiest way I can tell you to make appropriate categories is to take a few month’s worths of bank statements and see what all you spent money on.

It’s ok to change your budget as things come up, the main goal is to make sure everything is counted and covered.

And I can’t stress this enough…you don’t have to get it right the first time. It’s ok to make mistakes and the biggest thing is to make forward positive progress.

My Favorite Budgeting App

Let me throw in a quick tip that really helped me when I started our budget in the beginning.

Once I got my rough draft budget down on paper and made all the appropriate adjustments, I went to EveryDollar.com and used their free version on their budget app.

You can adjust it to mirror the one you have on paper. It is free if you manually enter each transaction (which is what you do on the paper budget) yourself, or you can choose the paid version and link it to your account so it does it automatically.

(I have multiple accounts so this didn’t work well for me and I just entered it manually anyway.)

The paid version links to your accounts and automatically uploads transactions for you. The website (also an app) was designed by Dave Ramsey…the budgiest of all budgeters! I love the free version, it just takes some of your time because you enter each thing by hand.

It’s an awesome resource to help you if you are not afraid of technology!

(The Budget Hustle is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.)

Here are a few paper budget planners if you like to write things down and need a little help. I like to use markers and stay organized. I have a planner that I designed to sell on Etsy that you can find here.

Getting it Together- Paying things off

My husband and I have recently decided that we want to minimize our spending in order to pay off the things we have. This includes our house.

Update: I recently paid off my car (whoo hoo!).

It will require some discipline from both of us to get it going but when we are finished and we have no payments…our world will change dramatically. (I will definitely keep you posted on the progress).

If you have a bunch of debt that you need to pay off I recommend the Snowball method that Dave Ramsey talks about. Click for Dave Ramsey Budget I have used his method and it works!!

Basically what you do is set an amount that you are willing to pay.

Start by paying off the smallest balances first so you feel that you are making progress and then you move to the next until they are all paid.

You continue to pay the minimum on the balances that you aren’t focusing on until you are ready to move to the next.

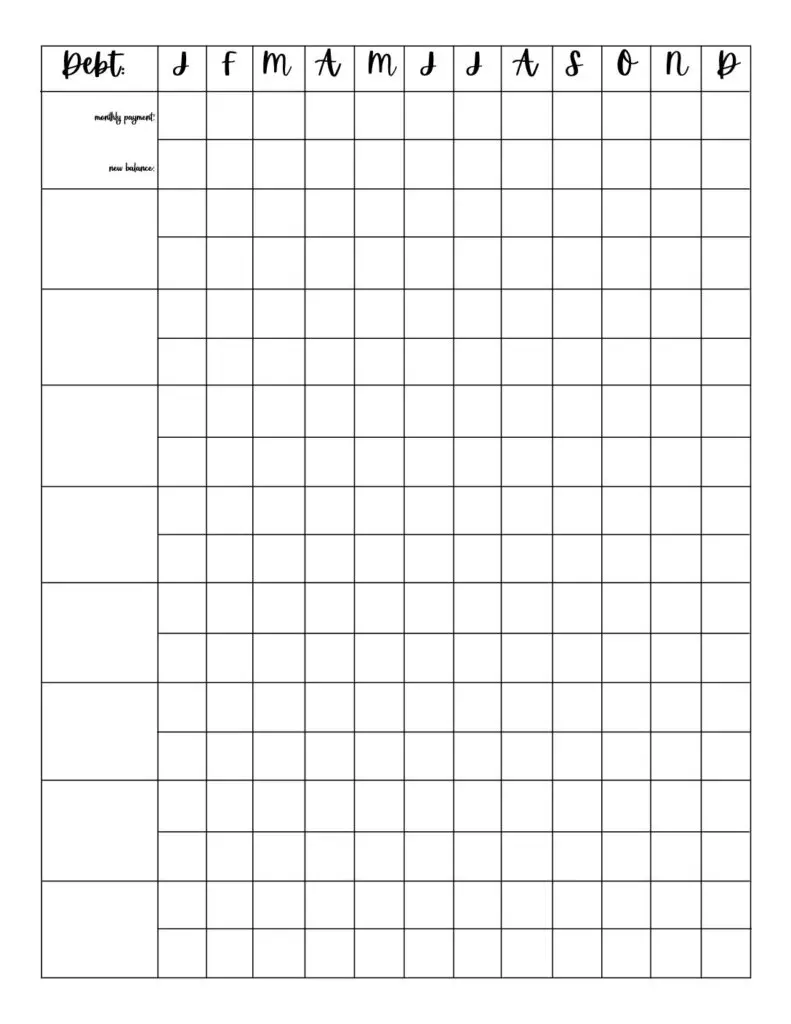

If you need a worksheet to use, you can download my Fillable Snowball Tracker Sheet here.

I like to pay the highest interest rate first, but you can also choose to pay the highest balance first. It’s really up to you. There is also a site called UnDebt It with snowball calculators you can utilize.

Conclusion

Getting your life in order is such a fabulous feeling. I hope you enjoyed my budget for beginners post! If there are any questions you have, I can try my best to get you the answers you need.

You can email me at thebudgethustle(at)gmail(dot)com or you can follow my Pinterest boards to stay on top of what’s going on with me!

Go check out some of my other helpful posts:

The Best Apps for Saving Money

And let me know below if you have a tip that could help other people out with their budget struggles!!