This site contains affiliate links to products. We may receive a commission for purchases made through these links.

I used to have a hard time saving money. It seemed impossible because I didn’t have my financial situation in order. If I could do it all over again, I would change so many things but since I can’t I have just made sure to learn and grow from the mistakes I made in the past. One thing I discovered that helped me save money was the bi-weekly method. I’ll show you.

Before you start any savings plan, you have to remember that life is unexpected. Who would have thought we would be living in an actual pandemic that would completely shut our world down. I didn’t. I remember the Friday before the shutdown, I started to panic and then I remembered that we had a large cushion in savings which made it easier to relax when the rest of the world was in panic mode.

In order to be successful you have to start saving little by little. It’s not impossible and you can make a way where you thought there was no way.

Set Your Goal

I know you have heard of money saving challenges. It’s simply just a goal you set for yourself and the challenge helps you achieve it. Money challenges are so popular on Pinterest and there are a thousand ways to do one.

I believe that there is no savings goal too small. I also believe that you have to take baby steps when you are making changes with your money if you want the changes to stick.

So, start small. Even if you start with just $100. Reach it and then double it or even triple that goal. Before you know it, you could have $1000 in savings.

How to Set a Goal

First, you need to have a budget. Then you can sit down and find places to cut spending. This is going to help you determine how much you can challenge yourself to save. You can’t just make money appear, so in order to set a realistic goal, you will need to find a place to cut.

Next, decide how long you are willing to commit to the goal. For example, If I looked over my budget and decided I was going to cut out buying coffee on the go and it was going to save me $20 a week, then my savings goal would be $20 per week or $40 bi-weekly.

Then, I’m going to decide that I want to save an extra $500. So, I would need to save for 25 weeks to achieve this goal. Boom! There you go. It’s really that easy.

Note: the reason I like saving bi-weekly is that I get paid every other week so it makes the most sense for me.

Where to Put Your Money

Once you have decided how much you are going to save, it’s a good idea to know where that money is going to go. I wouldn’t recommend the piggy bank method, because it’s too easy to take money back out of.

You should have a separate savings account set up for this money to sit in. This can be either an account with limitations or one that can be easily accessed. If you think it will be too easy, you can set it up in a savings account with penalties for withdrawing to help keep you from touching it.

The only reason you would want to be able to get to it is for emergencies and they do happen. You just need to make sure that buying new clothes isn’t what you consider an emergency.

I like Smarty Pig, (I’m not an affiliate for them) its an online piggy bank that allows you to earn a little interest while saving your money. There are no fees and they have a high APY. It’s through Sallie Mae and is currently FDIC insured.

When you sign up, you link it to a funding source (a bank account) and then set up a savings goal. It tracks your progress and helps you stay accountable.

You can also choose direct deposit. Employers that use direct deposit will let you set amounts that go into certain accounts. It’s super simple to sign up for it and all you need is the bank’s name, account number, and amount you want to set. When you make your savings automatic, you will do it without even thinking about it…before you know it, you will have reached your goal.

Bi-Weekly Savings Plan Ideas

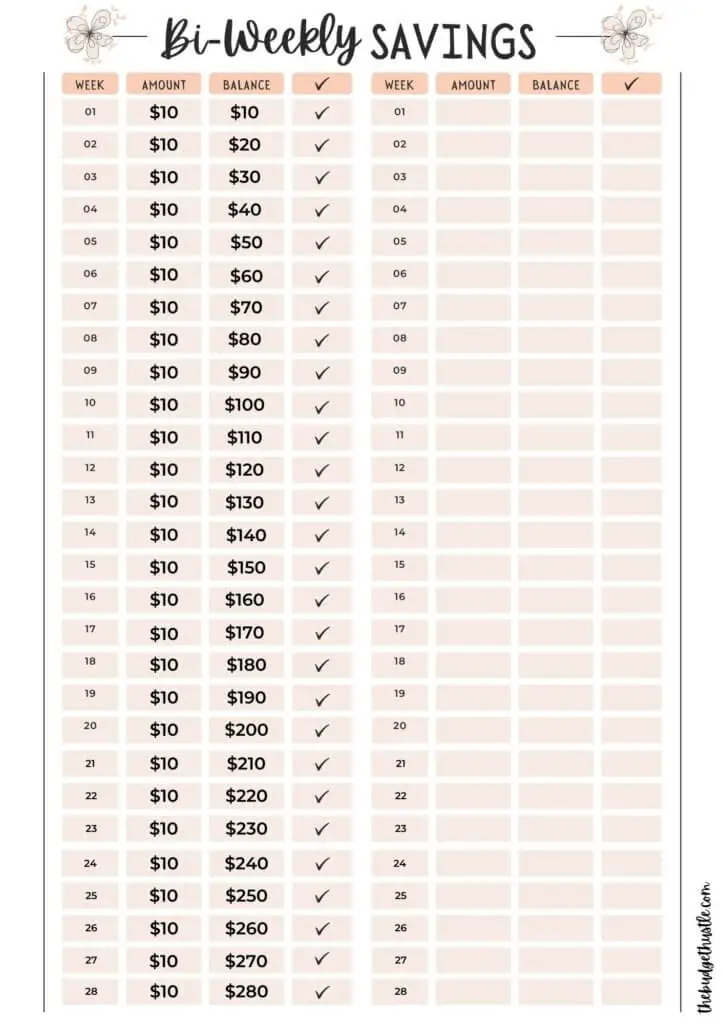

You can start with as little as a dollar. Then increase it each time or customize it however you would like. It’s possible to do it weekly, bi-weekly, or monthly if you choose. That’s the beautiful thing about it… it’s super customizable.

Grab this Free Printable Here! (blank and customizable!)

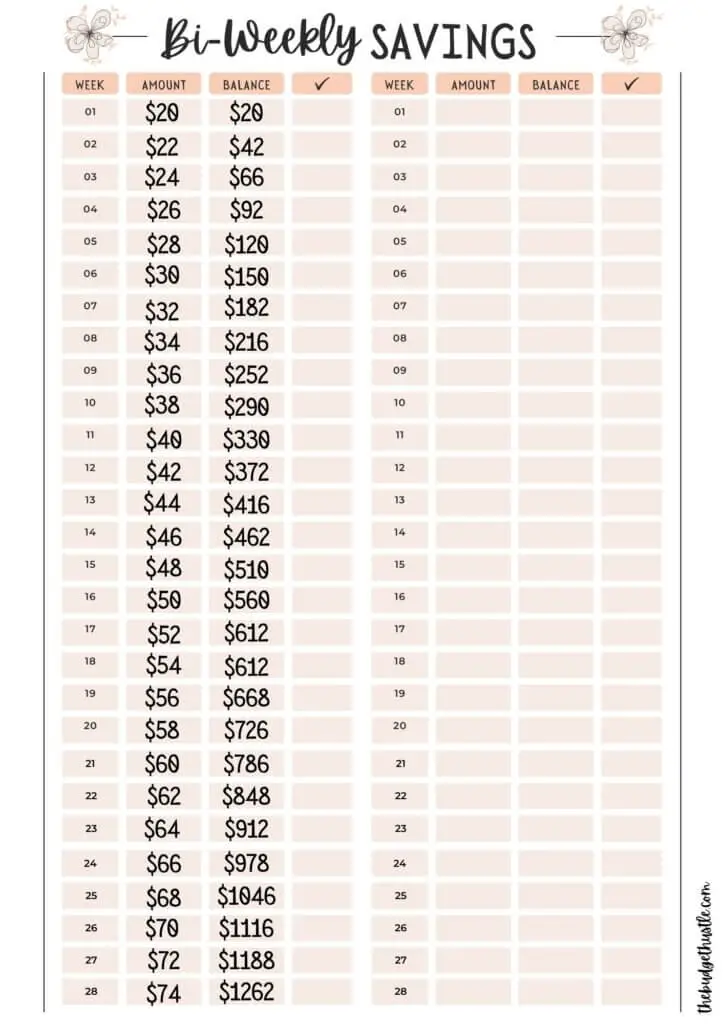

In my example above, I showed what saving $10 biweekly would do for a year. Since there are 56 weeks in a year, I halved that to get 28. If you wanted to do a weekly challenge, just continue on to the other side. Once you choose bi-weekly, then you can complete 2 challenges on one sheet.

Do you want to spice things up, start with $20 and increase it each week by a certain amount? Example: $20 and increasing it by $2. You will start with $20 and end with $1262.

Why you should save?

You should always save for the unexpected. Things come up and it’s best to be prepared. It’s also better to pay for things because you have saved instead of using a credit card, like for vacations.

You can turn this into a Christmas savings fund. It would be so easy to save $1000 or more to spend on gifts. The best part is, if you don’t spend it all, you can save it!! I promise you will get addicted to saving.

Save Save Save

I just love to save. I love coupons and discounts, too. If you put in a little extra work, you can find all the deals any time of the year. I started meal planning and I was able to cut my grocery bill in half.

I also love to be frugal. It’s become a competition to seek out all the best deals. My favorite places to save are TJMaxx, Aldi, and Marshalls. Not only can you find deals, but you can also get deals on your bills too.

I called Verizon the other day and saved myself $60 per month by upgrading my plan to a better one. Apparently, the plans get outdated, and sometimes you can get a deal if you just ask.

Speaking of asking, call your other providers and see if they will negotiate. I was able to negotiate my dish bill before I decided to cut it off and use Hulu. Even though I didn’t keep it, they were willing to cut the price. If they will do it for me, I’m sure you can try it too.

Conclusion

The most important lesson to learn here is you have to start somewhere. Make yourself a savings plan, write it down, and get started.

It doesn’t have to be hard or seem like a chore, in fact, once you get started you will see that it’s kind of fun.

Here is one more opportunity to get your blank checklist here.

If you made a plan and rocked it, tell us in the comments below. It could be just the motivation someone needs to get started today.