This site contains affiliate links to products. We may receive a commission for purchases made through these links.

I know that saving money can be extremely hard. Trust me, it’s something that I use to struggle with long ago, but I learned in order to be successful you need to set small goals and achieve them one at a time. This is why I love the $10 challenge to save money.

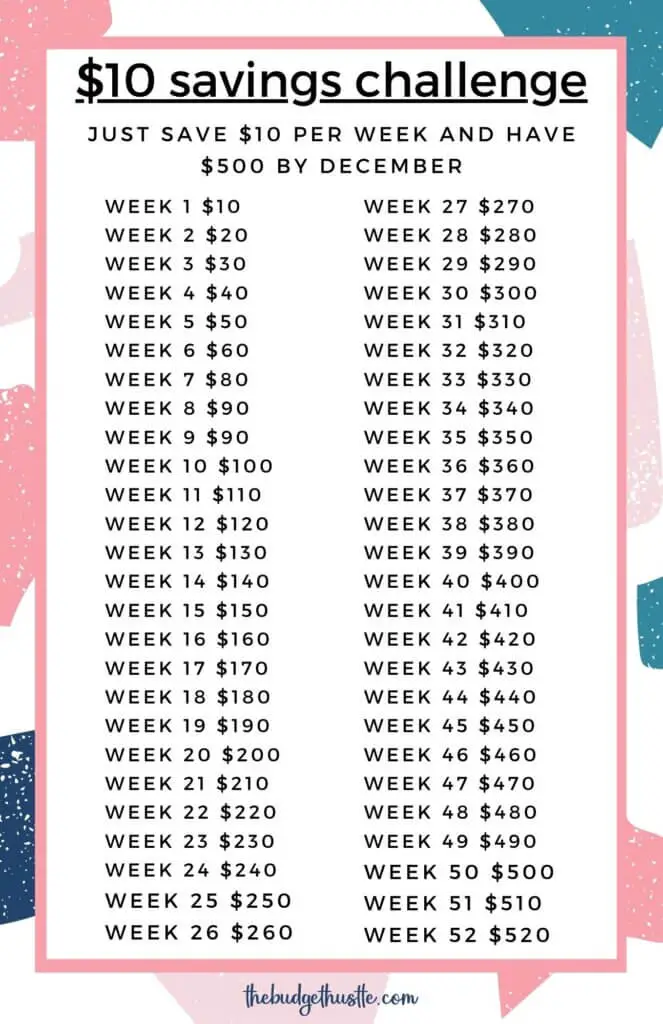

The $10 challenge is so easy that pretty much anyone can do it. You basically just set aside $10 per week every week until you hit your goal.

Download the PDF printout of the $10 challenge above and use a highlighter or pen to keep up with your progress. It can help you stay on track and it’s free to use.

What is a Savings Challenge?

A savings challenge is simply when you set a certain amount of money aside each week or whatever the set time is until you reach your desired savings goal.

Usually, savings challenges are a year in duration but you can customize it to meet any savings goal. That’s the beautiful thing about it. If you need some money for Christmas, you can start now and set any amount.

For so many people, getting started is the hardest part, so I recommend starting small and achievable. Just know that it is completely up to you and what you feel comfortable with.

Set A Goal

Setting a small goal at first will help make sure you are more likely to reach the goal. The $10 challenge is an easy first-time challenge to finish. If saving money is hard for you, try this one then move up from here.

Once you get started and make saving money part of your budget, it will become easier to do and you will build a habit to save.

I love to save money, once I get started it’s sometimes hard for me to stop. (which isn’t a bad thing- I love to see the money grow) The bad part about this is if I’m saving towards something, I can talk myself out of the “something” just to keep the money in my account. Crazy I know, but it has happened.

Store Your Cash

Figure out where you are going to keep the money. You can save it as cash, put it in a separate account or “hide” it in your bank account.

We have saved money all 3 of these ways and been successful with each. I have to tell you a funny story about the first time my husband saved cash.

We were saving for me to be on maternity leave with our first child so he would take $100 at a time and hide it under the bedpost. While this wasn’t a real good idea, he was able to stash away enough for me to be out for 8 weeks on maternity leave.

Now when we save cash, we put it in our safe so it’s protected from possible environmental factors and thieves.

If you decide to open a separate savings account, you can find an interest-bearing account that will also make you money while your money sits. I have one with Discover and it makes me extra cash that’s automatically deposited.

The last way to save is to “hide” your money in your account. If you keep a check register, you can use a different color pen to keep up with the amount separately. I usually skip a line between transactions anyway so I would use that line to keep up with the savings amounts.

Find what works best for you and stick with it. For us, it’s easier to hide cash in the safe.

Make Adjustments

Some people have such tight budgets, they wonder how they can squeeze out anything extra. Trust me, you can. You have to be willing to either make a little extra money or cut out some luxuries you enjoy (even Netflix).

We cut satellite tv out years ago, saving us $70-80 per month and I don’t miss it at all.

Self-Control

Being able to have some self-control is hard. This is when you may have to boost your ego and remind yourself that you CAN do this!

If you love getting coffee in the morning? Well, you can make it at home to save that $10 per week. Try packing a lunch from home instead of eating out and using the money you would have spent on lunch towards the weekly savings goal.

Side Hustles

You can also try a side hustle. There are so many ways to earn extra money every month. I have an Etsy shop that brings me an extra $200-300 per month. I also manage Pinterest accounts for a couple of clients which makes me an extra $700 each month.

This kind of extra money is huge, it can be used towards debt or savings goals.

I also have an entire article on side hustle ideas you can see right here.

Remember to Set it Aside

If you are afraid you’re going to forget to store that cash, set a reminder on your phone or make yourself a note to hang on your bathroom mirror. Whatever it takes. Just do it.

It’s also fun to ask a friend to save with you and you can each hold each other accountable while you remind each other of your goals. It’s fun to brag in a friendly way about your progress with someone who gets it.

Reward Your Efforts

When you reach a goal, you deserve a reward. It can be something small or something bigger, just make sure it fits within your budget. If you decided to give up your coffee, reward your goal with a cup from your favorite coffee shop.

What to Remember

Don’t let saving overwhelm you! Remember:

- Start Small

- Stay Flexible

- Make it a Game

- Notice Your Results

Remember self-control. When you need to dip into the savings stash, don’t! Remind yourself why you are doing it and how rewarding it will be in the end. You can ask yourself if whatever you are dipping out of the stash for is really worth it? It’s probably not!

Many people struggle with saving, especially getting started and sticking to it. But I know you can do it!