This site contains affiliate links to products. We may receive a commission for purchases made through these links.

The definition of “tight on money” is: don’t have much. Well, I don’t know about you but this can be a problem. It is for me anyway. We have all been there at some point in our financial journies.

I’m here to tell you that it’s ok. I have some tips to share that will help you get through this season and hopefully come out on top. Staying in denial about your money situation will only cause more heartache down the road.

1. Check Your Priorities

If you are tight on money, you might need a reality check. As much as we might not like it sometimes, we need to check our priorities.

If you haven’t started a budget, I strongly suggest you begin with this. Starting a budget will help you see where you are spending and what you need to trim.

2. Keep Track of Every Dollar

This goes with budgeting. In order to know what you are spending, you need to track every dollar and what it’s doing for you.

You need to grab your bank statement or print one out. Go through it with a fine-tooth comb and see where your money is going. I had my teenager do this when he spent $900 in a month and a half. YES! You read that right. I almost had a heart attack. It was his money to spend but it’s also my job as a parent to teach him good money habits now.

When he realized how much money he was wasting, he realized he had to make some changes. We had to help him along the way because he couldn’t control the impulse spending.

I did this by giving him a set amount of cash every week. We also made it very clear that when it was gone, it was gone. This way he could physically see it leave his hand.

You can do this as an adult if you are having issues with spending. The envelope system is very common and it can help you realize where your money goes.

If the envelope system is not for you, just stick really closely to your budget. Each category should have a set amount that you can spend on it.

3. Determine your Wants from your Needs

This is a tough one for me and I know most people out there. I want a lot of things, but I don’t always need them. There is a huge difference between the two.

A want is the desire to possess something and a need is something that’s essential or very important that meets your basic needs.

An example of a need is your rent, power, and grocery bills. Wants would be a new cell phone, clothes, the latest game or a gadget.

Getting this category under control will show you how bad you really want it. But unfortunately, when money is tight you might now have a choice.

4. Work on your Grocery Budget

I love this one because I have been able to cut my grocery bill so much. I do this by using discount stores, utilizing coupons, meal planning, and ordering groceries online for pickup.

Yes, believe it or not, this is the best thing I have discovered since the pandemic that I know will save me lots. It keeps me out of the store and focused only on what I actually need.

Also, I can use the sale paper while I shop online and I can clip coupons digitally that match the items I’m purchasing. If you haven’t tried it, I highly recommend it.

You can also buy in bulk when items are on sale so that you can get the most from your dollar. This may not be feasible for some but if you were to trim some money from unnecessary spending I bet you could.

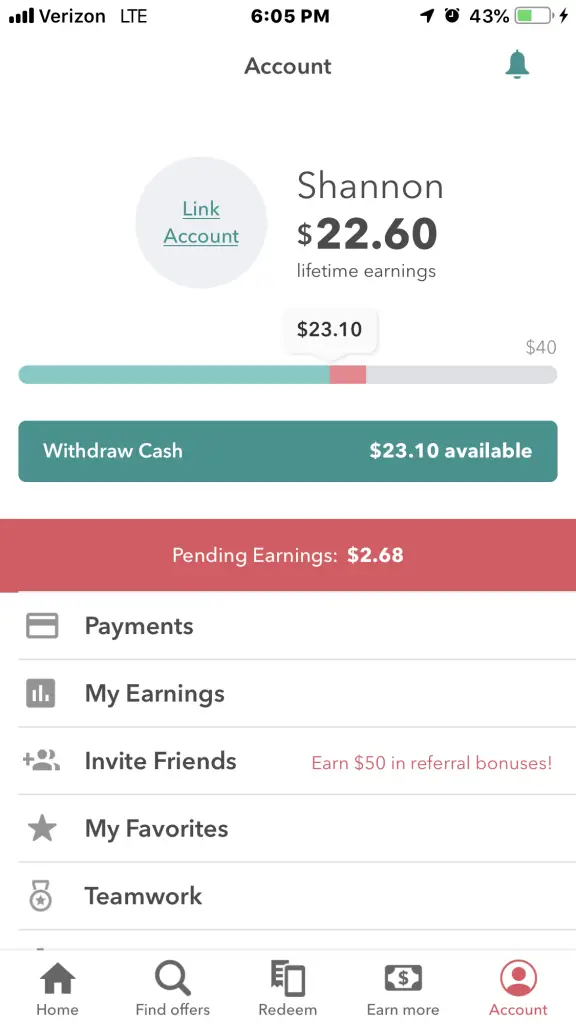

I also use the Ibotta app when I am grocery shopping to get money back. There is a screenshot below of the first $20 I made from Ibotta. I don’t use it like I could but I have gotten $51.08 back so far.

5. Cut the Cable

We did this several years ago and haven’t looked back. I was paying $100 for satellite tv and $100 for the internet so we decided to cut the cord and use Netflix and Hulu for tv. I honestly don’t miss it at all and it has made my family watch it less.

6. Slim down each Budget Category

In order to save money, you might have to do a reassessment of your budget categories. Sometimes we don’t realize what we actually spend until we sit down and look.

I challenge you to cut $25 from each category that isn’t a necessity and see how much you end up saving. I know groceries are a necessity but I know you can find $25 to cut after what we talked about earlier.

7. Pay Down Debt

Getting rid of debt will free up money when it’s tight. You can do this several ways.

- Get a side hustle

- Sell some of your things you don’t need

- Use cash back apps and then pay debt with that

- Cook at home and eat out less

- Make coffee from home

8. Use Cash Back Apps

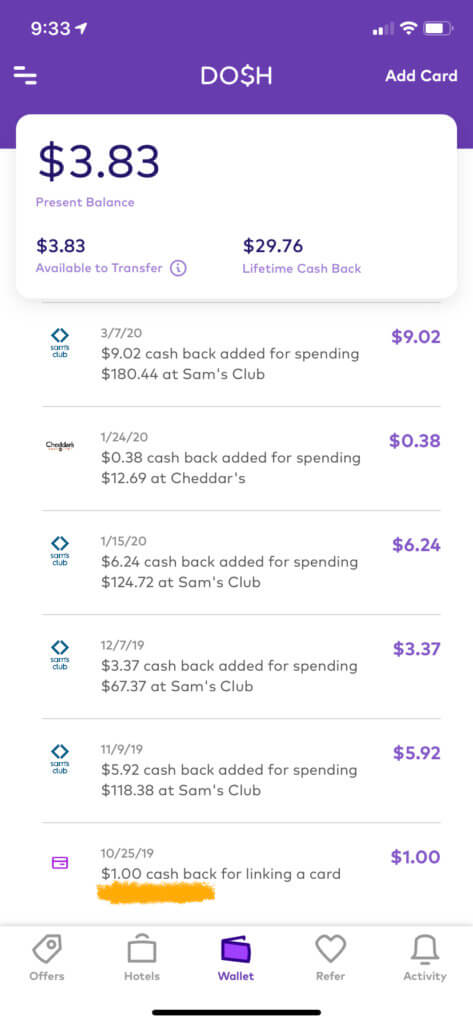

Cash back apps are my favorite way to get free money. I use Ibotta and Dosh the most. Dosh requires the least amount of effort. All you have to do is attach your card to your account and it’s automatic.

I also have an entire article dedicated to money saving apps.

9. Get a Side Hustle

Side hustles are my life. I have several. Having multiple income streams is actually how millionaires get rich.

There are so many to choose from, I have an article dedicated to side hustles that even introverts can do. My favorite side hustle is blogging. It’s by far one of the harder ones to do but it’s the most rewarding to me.

I also have an Etsy shop where I sell SVG and PNG designs that I create on Adobe Illustrator. This past Christmas, my store made me an extra $400 in December. All of that income was passive.

Another hustle I have is managing Pinterest accounts. This hustle brings me in an extra couple hundred per month and only requires a few hours a week of my time.

10. Eat at Home

This right here is gold. It’s hard to do but when you master it, you will see the savings pile up. I just think of eating lunch out everyday and spending $10-12 each time. That’s $50-60 per week and $200-240 per month. You could pay down a debt with that kind of extra cash flow.

11. Live Below Your Means

Living below your means is the entire point of this article. It’s not just about cutting costs, but it’s about changing your money mindset to save.

Create a plan, which is a budget. You can use a traditional budget or try the 50/30/20 budget. Creating a plan will help you make good financial choices.

You could try living off of one income. If you are able to do this, the other income could go directly to savings and you can really see it add up then.

Be sure your house and car aren’t too big for your budget. You don’t have to have the fanciest car or the biggest house. Yes, they are great but will anyone honestly remember you for it? Nope.

I love to buy used. This defiantly keeps me below my means. Poshmark is a great app for buying used clothes (code: SSEAWR5923 will save you $10) and facebook marketplace is a good place to find used items. You could also hit up goodwill. I have found some gems in that place before.

Consolidate your debt to decrease the payments, you can often times get a low interest loan that will help you pay it back faster. This could help you live below your means by decreasing debt and payments.

Conclusion

Living a frugal lifestyle is hard but can be so rewarding when you stop focusing on everything else and focus on yourself. Be sure to reward your victories along the way to help you stay empowered to keep moving forward.

I know it’s hard but taking control when money is tight but moving forward will be the best for you in the long term. Go follow me on Pinterest for more frugal living tips and tricks. Good luck in all your future money adventures.