This site contains affiliate links to products. We may receive a commission for purchases made through these links.

Today, I sit at home with my kids trying to figure out how to homeschool because our schools have been closed temporarily while we try to keep the spread of the Covid-19 virus to a minimum. Sitting here, because I can’t work, has made me realize that I am very fortunate to have an emergency plan in place for times like this.

I want to share some of my tips to make sure you are able to survive a financial interruption like this also. No one wants to be put in this situation but when we are, we need to be able to adapt…quickly.

I have experience with living thrifty from my two maternity leaves. I had to save my money ahead of time and live frugally while I was out with my babies. I took the money I had saved and divided it between the 6 weeks that I was taking off (with no pay). I budgeted my money according to these weekly amounts that I allowed myself.

My goal was to spend less than I had saved and pay cash for my hospital bill. I negotiated the bill with the hospital and they took 20% off for paying cash in full. It was a win-win for me.

You can also do things like this to save big when you need it most.

Have an Emergency Fund

The best way to make it through a time of crisis is with an emergency fund set in place. If you don’t have one and you are currently in a crisis, it’s ok. When the dust settles and you are back on your feet, this can be something you start asap.

(I know this doesn’t reassure you at the moment and I hope the government or your job can help you financially during this Covid-19 shutdown.)

I have a savings account and this is my emergency money. You can add in monthly amounts from your budget to help you build it up. The best way to start is by setting a $1000 goal. Once you get there, decide on an amount that would help you live for a month or two if you go without a paycheck in the future.

Keep Grocery Staples on Hand

We keep things in our pantry all the time like rice, beans, soups, and other non-perishable items. This can be a go-to if you are not able to grocery shop or if funds are low. It’s a great idea to have things you can eat easily. The kids don’t always like it but you do what you have to when you are in a financial crisis.

Don’t Panic

The best thing you can do is not panic and remain calm. Bad decisions are made when you are in freak out mode. Don’t rely on social media for your answers. Listen to only facts, use your common sense, and make your own decisions

Look for ways to Earn Extra Money

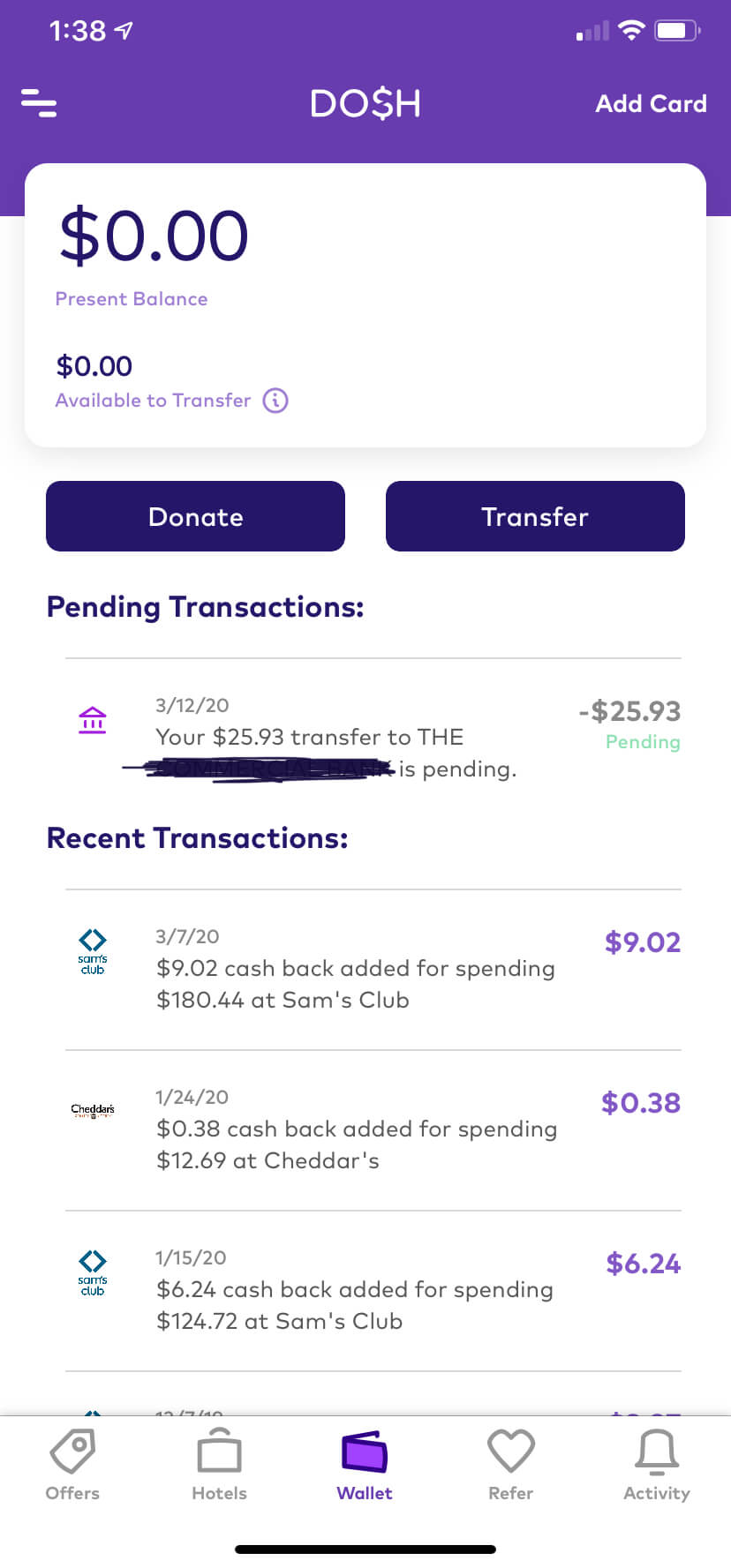

There are so many ways to earn extra money these days (even during a financial crisis)…earning money online is easier than ever. I just transferred $25 from my Dosh account.

Dosh is an app that allows you to connect a card that you use to spend with and it automatically connects to offers when you spend. As you can see above, when I go to Sams Club it automatically gives me 3% when my card is run as a credit.

I have an entire post about making money at home.

Save on Groceries

One way to save on your grocery bill is to plan around sales. If you meal plan already, this should be pretty easy. Just pull up the weekly sales flyer online and see what the sales are and plan from there. You can google pretty much anything these days so if the chicken breasts are on sale, google something like “easy cheap chicken breast recipes”

This is how I meal plan. I find recipes based on what is on sale and searching it on google.

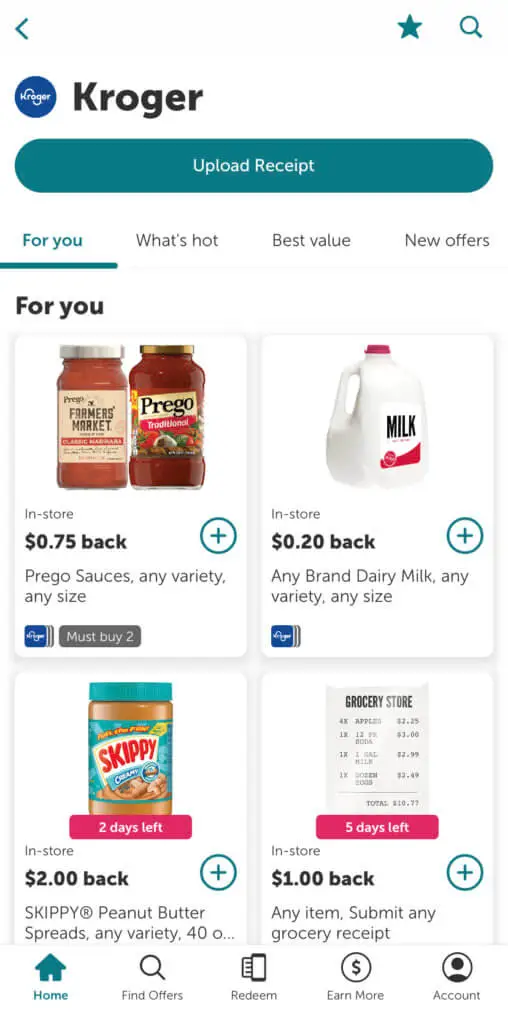

Another way to save on groceries is to use coupons. There are so many digital coupons available for you to use very easily. If you have the Kroger app, you can simply set up an account and start clipping digital coupons today. Publix also has digital coupons.

I use an app called Ibotta to get money back when I shop. You just pick a store, scroll through and clip offers, then upload your receipt.

Another way I save money on groceries is to take advantage of the grocery pickup. I use Walmart’s grocery pickup because they don’t charge a fee to use it, you just need a minimum order of $35. When I use this service, I am not tempted by impulse buys or getting things because I am hungry. I know I’m not the only one out there guilty of this, lol.

You can see the entire post I wrote about Simple Grocery Budgets.

Cut Bills

If you need to cut costs quickly, you can negotiate your bills. It never hurts to ask. We did this once with our satellite company (we were willing to call their bluff) and they cut our bill. We ended up canceling the whole thing later to save money and now we only use Hulu.

Here is an example script: “Hey, I’m __________ and I am thinking strongly about canceling my satellite service with you unless you can offer me a better deal. I’m currently looking into a different plan but wanted to give you an opportunity to keep my business.” It will go one of two ways…hopefully they will come back with a better rate.

We have also done this with our trash service…You can really try it with anyone!

You can also be thrifty with the utilities. Make sure you cut off lights and turn off devices that you are not using. We will open up windows and use natural light to keep the electricity turned off.

If negotiation is not an option for your tv bill you can always cut off cable. There are so many cheaper options to watch tv these days. My favorite is Hulu. You can also do Netflix or Amazon Prime TV.

Budget

A budget helps during any financial situation, especially if money is slim and you need to know where every single dollar is going. You can start a budget anytime!

No Spend Challenge

During trying times, a no-spend challenge may be just what you need. This can be an easy way to challenge yourself to spend on nothing other than necessities. It’s so easy to spend emotionally when we are having a rough time.

Don’t let your emotions take over. Remember to remain calm. You can do anything you set your mind to. You just need to make sure you are spending less than the money you have coming in or what you have saved.

I have some other posts that are for helping you save money:

Simple ways to Save Money on a Budget

Money Saving Hacks for Any Budget

Follow me on Pinterest for more money hacks and tips.

Great tips! We’re especially focused on spending mindfully right now. Actually, other than supporting some local restaurants to help keep them in business, we’re not spending money on anything but the essentials right now. Quarantine is great for avoiding expensive nights out, and dropping tons on travel. I guess there are positives in this after all.

It certainly is. This is my first time ever on un-employment so I need to be frugal now more than ever!

These are some great tips to save money that I can easily add to my daily routine! I’ve noticed that there are a lot of little things I usually spend money on that all add up, but being stuck at home has definitely reduced this spending!

You are so right! It takes slowing down to realize it.

Great ideas here! Cut bills is a great idea. It’s amazing how we think we can’t live without something until things really get down to the grind. Then, suddenly, we discover there are things we can easily cut from our budget.

It’s amazing what you can find when you have to!

These are all great ideas! I’m fortunate to have multiple streams of income online, to make up for my full-time job (I’m in the service industry by day) right now, but I know many do not. I can’t imagine. Love the idea of a no-spend challenge!

-Madi xo | http://www.everydaywithmadirae.com

You are so fortunate!

These are great tips. And timely as well with so many people out of work. Budgeting and planning for a crisis is something that so many people put off. Why? I’ll never know. It’s so freeing to feel the way you do right now, no stress over money during this crisis. It’s good that you are sharing these tips!

i appreciate that you gave an example of how to negotiate or communicate with those bills you are paying for. i know personally for me when tried to talk to my parents or friends about trying to reduce their payments…they always jump to ‘they won’t do it’ without even trying

They will when they know you are serious!

These are some tips that I surely follow, with so much going on now in the world we have to start thinking far ahead. Thanks

yes we do and its always good to be frugal, especially in times that are uncertain.