This site contains affiliate links to products. We may receive a commission for purchases made through these links.

I love deposits. Putting money I have earned into my account is one the most satisfying things on the planet. Sometimes, however, you deposit your hard earned cash only to see that pending deposit in your account. Can you spend it? When will it be available? I’ll explain.

Every time you make a deposit, your bank has to verify that it’s legit. So if it shows it as pending, you can’t use your money just yet. You actually can’t use it until it’s been placed in the available balance section.

So, you need to be very careful how you manage your money. Long ago, I would spend what I made and not have a cushion built up in my account. Now, after I learned to budget, I have more money in my account than I spend so I can afford to wait for the deposits to clear.

Note: Banks must make the first $200 available to you, regardless of the type of deposit, the next business day.

What happens if you spend it before it’s avalible?

It is absolutely necessary that you wait until the pending deposit is showing available before you start to spend this money. If you don’t, you will be at risk of over drawing your account.

One way to speed up your funds availability is to use a checking account that gives you access to your money sooner. Axos Bank has an essential checking account with a feature that allows direct deposits to be paid up to 2 days before other banks. They also have no minimums and no overdraft fees. They let you use unlimited domestic ATMs by reimbursing the fee.

How Long Do Holds Last?

Banks can set their own amount they allow to be available from your deposit. If a bank says 2 business days, they mean Monday through Friday, not counting holidays. So if you make your deposit on a Saturday, you won’t have access to all of it until Wednesday.

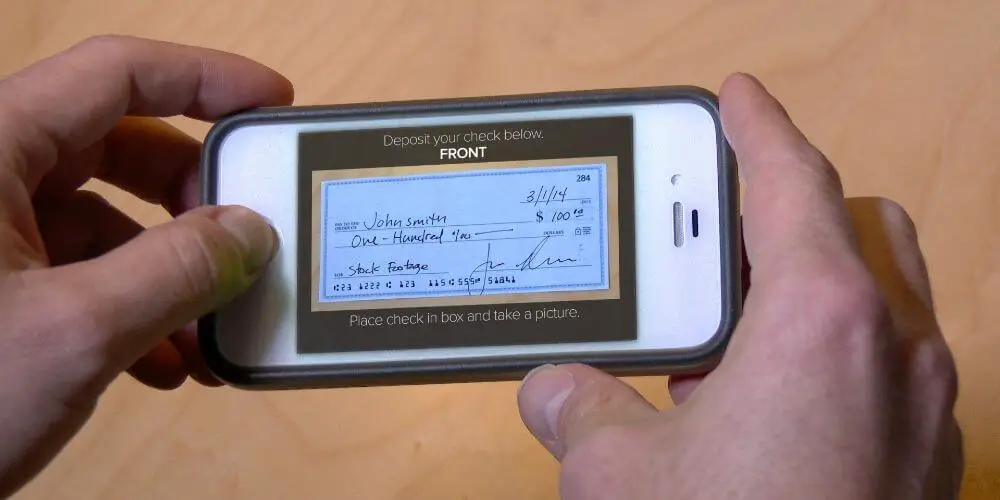

Thanks to being able to digitally send pictures of checks, it has gotten a little faster to process funds.

If a bank thinks there is a reason your deposit is suspicious, they can place a hold for more days. I have made larger deposits in the past and my credit union released part of the deposit that day and the rest of it 5 business days later. This is to protect them while it processes.

The only way to insure immediate access to your deposit is to deposit cash. You have to do this in person though.

Read the Federal Reserves Funds Availability Regulation here.

Other methods of next day or same day deposits:

- Cashiers Check, Teller or Certified Check

- US Treasury Checks, Money Orders or Checks from a Federal Reserve Bank

- Checks from the same branch or bank where you are depositing

Can it get rejected?

Absolutely! Your bank can reject a pending deposit if they verify the funds and it’s unavailable. They can contact the bank where the check is from and if they verify no funds, it can be denied.

Other Reasons the Bank Could Hold

- Banks can place longer holds if you have a new account thats less than 30 days old.

- If you try to redeposit a check that was returned unpaid

- You deposit multiple large checks in one day

- If you have a history of overdraws

- There is a communication loss or computer failure

Common Banking Terminology

Its easy to get confused when you look at your bank account. You really need to make sure you learn what the common terms mean so that you can have full control over your money.

Deposits

This can also be called “credits”. This is usually a separate section on your statement. This is the money that gets added to your account either from a paycheck, other personal check, cash, money order or etc. Only deposits that have been authorized by your bank will be added to this section.

Available Balance

This is the money that has been authorized by your bank for you to spend. If you have used your debit card or deposited a check on the same day or next day, these transactions won’t be calculated in.

It’s important to pay attention to this if you don’t allow yourself to have a cushion in your account of extra funds.

Pending Transaction

This is the debits or credits I just mentioned, the ones that have occurred recently but haven’t been approved yet. You should make sure you pay attention to the debits because this is money waiting to be taken out and can affect your available balance. The bank is going to subtract these first to ensure the payee gets their money.

What you need to know

Banks monitor funds based off of previous account behaviors. If you can be trusted or have no history of overdrafts, they will release funds to you sooner. A hold is a way the banks protect themselves from losing money.

If banks release the money before they know they will have access to it, they run the risk of losing funds all together. Its just good business for them.

Things you can do to prevent holds

- Sign up for direct deposit- this way your money is wired electronically

- Deposit in person- making deposits at the ATM or your phone could take longer

- Ask for Money Orders or Cashiers checks- this could help you guarantee your money will be available to the bank

Conclusion

Pending deposits are there to protect everyone, especially the bank. If you were a bank, you wouldn’t want to loan money out without some sort of protection in place. Hopefully now that you have read this article, you have a better understanding of why things work the way they do and you have figured out ways around a pending deposit.